iGaming in 2025: The Growth Year That Redefined Organic Acquisition (and What Winning Brands Did Differently)

For most of the post-PASPA era, operators fought for visibility through aggressive promotions, media partnerships, and paid acquisition. The winning playbook was simple: spend more, launch faster, and outbid competitors for attention.

But by 2025, the market entered a new stage. It became more regulated, more expensive, and more concentrated. That change didn’t slow the industry down. It changed how winners win.

The defining characteristic of iGaming in 2025 is that the market stopped rewarding noise and started rewarding infrastructure. Brands that scaled successfully weren’t only the ones with strong product-market fit. They were the ones who built a defensible acquisition engine under real-world constraints: advertising restrictions, state-by-state legality, high taxation, and rising customer acquisition costs.

That is why 2025 became the year SEO shifted from a supporting channel to a core strategic asset.

This case study breaks down what happened, what the numbers reveal, and what iGaming brands should do next. Especially those operating in regulated U.S. markets.

The Market at Scale: iGaming Is Now a Major Digital Economy

By 2025, online gambling in the U.S. had moved past the “emerging market” label. Revenue figures, state adoption, and investor behavior began to resemble other mature digital verticals: fintech, streaming, and mobile commerce.

Forecasting and regulatory intelligence published in the iGaming industry projected that the U.S. online sports betting + iGaming market would reach approximately $26.8B in gross revenue in 2025, with the broader online gambling market projected to exceed $41B by 2028 under a base-case scenario.

This is important because it reframes iGaming as something bigger than “a betting trend.” It’s now a long-term consumer market where operators compete on retention, distribution, and brand trust, not just on odds and bonuses.

However, the U.S. is not one iGaming market. It is many markets operating under different rules, tax structures, and political realities. That fragmentation is not a temporary issue. It is the core strategic reality of U.S. iGaming.

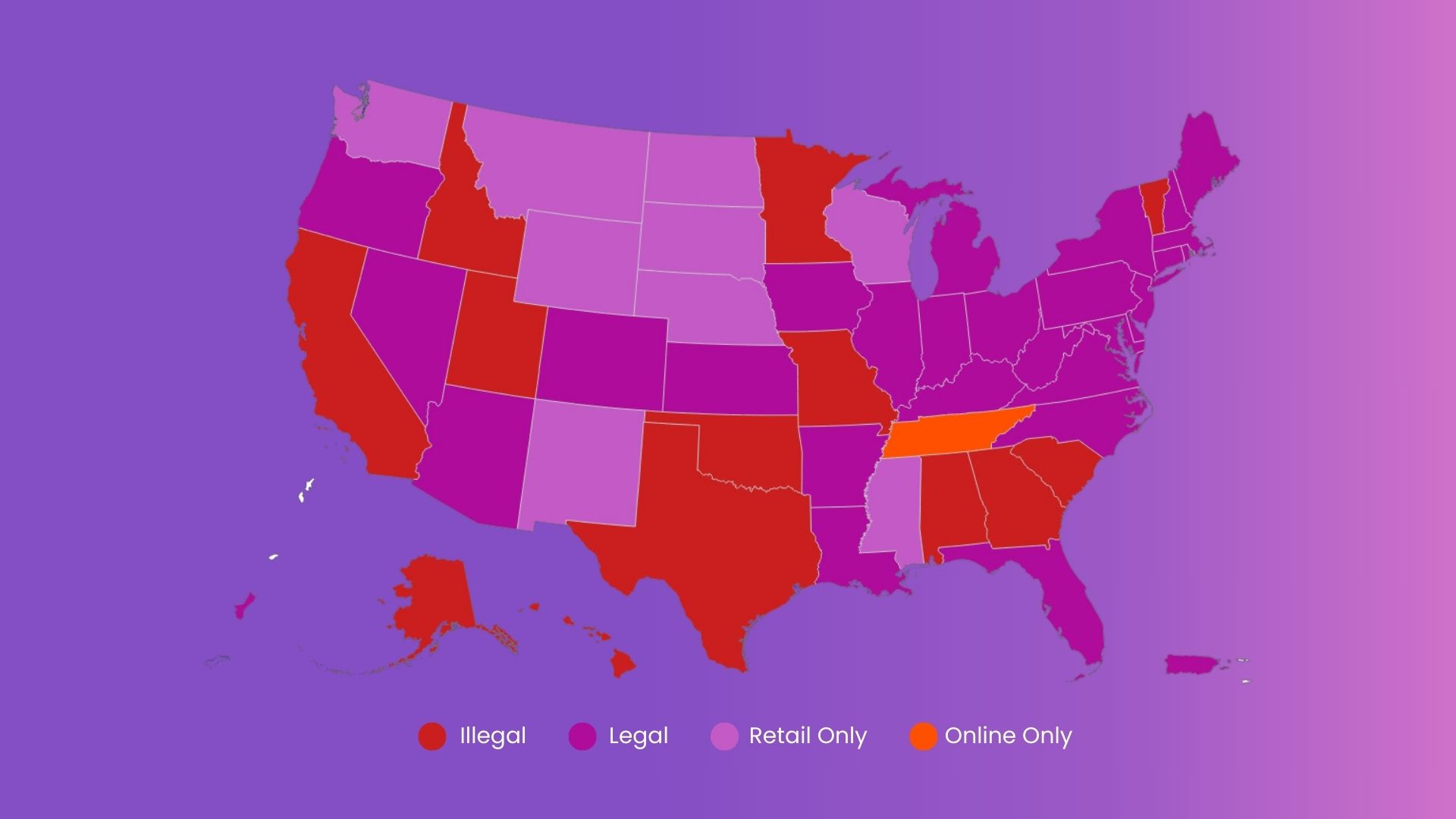

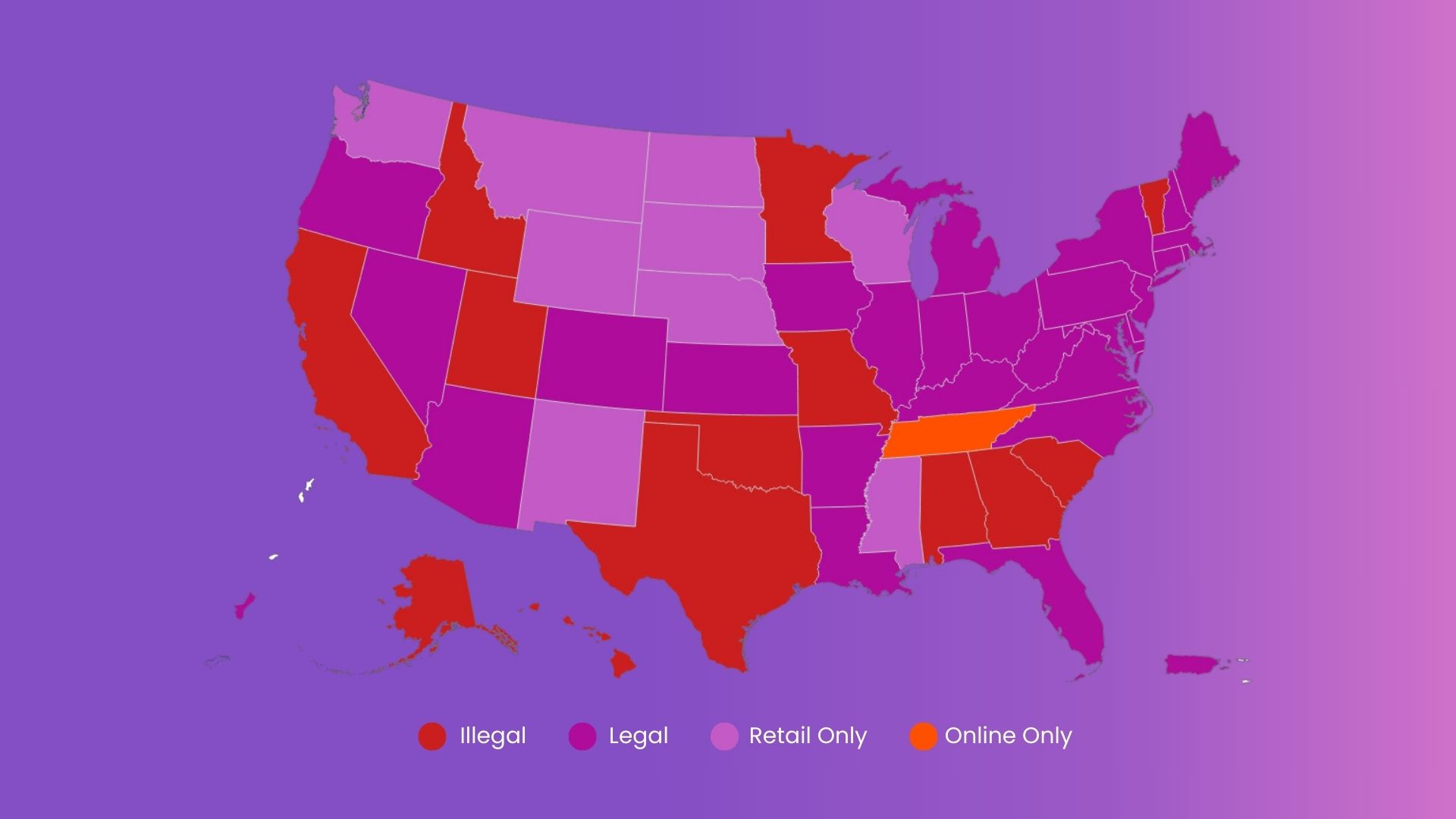

The U.S. Regulatory Landscape: Growth Happened Inside a Patchwork

One of the biggest misconceptions about U.S. iGaming is that legalization is moving in a smooth upward line.

In reality, 2025 showed how difficult expansion still is. Even as demand rises and mature states prove the model, new states remain politically complex. According to regulatory analysis in the attached Vixio report, as of December 2024:

- Sports betting was live or regulated in 39 states

- Full iGaming (online casino) was live in 7 states

- Online poker-only remained live in Nevada

This matters for one reason: the growth story is national, but the execution is local.

For operators and affiliates, this forces a different growth strategy. Instead of building one national funnel, they must build multiple state funnels, each with its own legal language, compliance requirements, and search behavior.

Michigan as the Proof Market: What iGaming Looks Like When It Matures

If there is one state that demonstrates what regulated iGaming becomes at scale, it is Michigan.

According to a report from November 2025, Michigan’s commercial and tribal operators reported $335.7M in combined gross receipts from iGaming and online sports betting for November. The combined total was down 4.7% from October, but the channel-level performance reveals the real story.

Michigan Online Gaming Performance (November 2025)

| Metric | iGaming | Sports Betting | Total |

| Gross receipts | $248.4M | $87.3M | $335.7M |

| Adjusted gross receipts (AGR) | $233.3M | $64.7M | $298.0M |

| Sports betting handle | – | – | $631.1M |

| State taxes & payments | $48.5M | $4.5M | $53.0M |

| Detroit taxes & fees | $13.0M | $1.4M | $14.4M |

| Tribal operator payments | – | – | $5.5M |

Even in a month where overall revenue dipped, iGaming remained the core engine of the market.

Sports betting delivered a record-high month in gross receipts, but it is still a smaller portion of the combined total. Michigan is one of the clearest demonstrations of the modern U.S. iGaming model: sports betting creates peaks, but iGaming creates stability.

The 2025 Industry Pivot: Sports Betting Became the Funnel, iGaming Became the Business

Across regulated states, the operator strategy matured into a consistent pattern:

Sports betting is the acquisition engine. iGaming is the retention and monetization engine.

This is not just a product observation. It’s a marketing observation.

Sports betting marketing is seasonal. It depends on the sports calendar. It depends on big events. It depends on short windows of high-intent activity.

iGaming is different. It is always on. It generates repeat sessions. It produces a higher lifetime value. It allows operators to build durable engagement loops through slots, live dealer, poker, crash games, and gamified loyalty systems.

This is why 2025 became the year that operators began treating iGaming not as an add-on, but as the core profit model.

Legislative Momentum in 2025: Where Expansion Is Actually Happening

Market growth is not occurring in a vacuum. Legislative movement in 2025 further clarifies where the next phase of opportunity lies.

Key U.S. Legislative Developments (2025)

| State | 2025 Status | Type of Movement | Expected Impact |

| Missouri | Voter-approved sports betting launched Dec 1, 2025 | Market launch | Adds a new Midwestern regulated market |

| Georgia | Sports betting bills introduced | Legislative effort | Potential Southeastern expansion |

| South Carolina | Sports betting legislation was introduced | Legislative effort | Long-shot but notable shift |

| Mississippi | Online expansion proposals introduced | Expansion effort | Mobile market modernization |

| Nebraska | Online sports betting expansion bill introduced | Expansion effort | Retail-to-online transition possibility |

Missouri was the only state with a launch date in 2025, which happened on December 1 following voter approval. However, multiple states introduced legislation this year, reinforcing that expansion remains active, though politically complex.

This pattern reinforces a key insight:

The U.S. iGaming market expands incrementally, not explosively. That means first-mover SEO positioning in prospective states becomes strategically critical.

The Real 2025 Problem: Acquisition Got Harder, Not Easier

The market’s growth in 2025 happened alongside a major headwind: acquisitions became structurally more expensive. Several forces converged:

1) Advertising restrictions increased

In multiple states, responsible gaming messaging requirements tightened, and advertising placements became more controlled.

2) Tax pressure intensified

High-tax states continued to compress operator margins, reducing how aggressively brands could compete in promotions.

3) The market is concentrated

A small number of operators dominated the share, forcing challengers to find alternative distribution advantages.

4) Compliance expectations rose

Operators were no longer judged only by product quality, but by their ability to market responsibly and legally.

These forces created a shift away from “paid-first growth” toward a hybrid model where SEO and organic authority became essential.

Why SEO Became the Highest-Leverage Growth Channel in 2025

In 2025, SEO stopped being a “marketing tactic” and became a strategic moat.

The reason is simple: paid acquisition scales linearly, but SEO scales exponentially.

In a market where paid media faces restrictions, bonuses are expensive, CAC is rising, and operators need multi-state profitability, SEO becomes the only channel that continues to grow while reducing blended acquisition costs over time.

That is the strategic reality of iGaming in 2025.

The State-by-State SEO Model: The Only Way to Win in the U.S.

The U.S. iGaming SERP landscape is fundamentally different from global markets.

In Europe, a casino brand can build one SEO strategy per language. In the U.S., a casino brand must build one SEO strategy per state, and each state is effectively its own ecosystem.

Michigan search behavior is not New Jersey search behavior. Pennsylvania’s intent is not Connecticut’s intent. Even the legality questions, deposit methods, and promotional phrasing vary across jurisdictions.

That means successful SEO in iGaming requires state-level architecture: state hubs, operator comparisons by jurisdiction, legality content by state, state-specific bonus and promo language, and compliance-safe internal linking.

This is why generic SEO agencies fail in iGaming. The vertical requires regulatory literacy and content governance as much as it requires rankings expertise.

E-E-A-T, YMYL, and Trust: The Unspoken Ranking System in Gambling

If 2025 had one invisible algorithmic theme, it was trust.

Gambling is treated as a high-risk category. It sits close to finance and healthcare in terms of user harm potential. That means Google’s ranking systems rely heavily on E-E-A-T signals.

In practical terms, iGaming SEO in 2025 rewarded sites that demonstrated editorial transparency, review methodology, responsible gambling positioning, consistent author credibility, and accurate legal language.

This created a major gap between content that is written for clicks and content that is written for legitimacy.

The 2025 SERP War: Affiliates vs Operators vs Media

Another major shift in 2025 is that SERPs became multi-stakeholder battlegrounds.

In many states, competitive keywords like “best online casino” and “best sportsbook” are now contested by national operators, state-licensed local brands, large affiliate networks, news publishers, and sometimes even regulators or consumer education sites.

This changed how affiliate SEO works. In 2025, affiliates stopped winning purely through backlinks and started winning through coverage depth: legality hubs, payment-method clusters, state-specific bonus comparisons, and strong informational content.

The Sweepstakes + Enforcement Topic: The Fastest SEO Opportunity of 2025

One of the most important emerging themes of 2025 was the spotlight on sweepstakes casinos and sweepstakes sportsbooks.

The Vixio report identified sweepstakes platforms as one of the key regulatory flashpoints, with enforcement actions and statutory restrictions likely to increase.

From an SEO perspective, sweepstakes became a perfect storm due to high search demand, low public understanding, rapidly changing legal context, and massive content gaps.

This created opportunities for both operators and affiliates to capture authority iGaming traffic by publishing legality explainers, state-by-state sweepstakes status pages, “regulated vs sweepstakes” comparisons, and compliance-safe education hubs

In 2025, this type of iGaming content often ranked faster than traditional “best casino” pages because it satisfied a stronger informational intent.

The Technical SEO Reality: Multi-State Operators Needed Infrastructure, Not More Content

By late 2025, many operators faced a scaling problem that content alone couldn’t solve. The issue was technical.

As operators expanded across states, they created overlapping landing pages, plus duplicate bonus URLs, inconsistent state messaging, and geolocation-driven rendering issues.

This often caused indexation confusion and keyword cannibalization, besides weak internal linking and poor state-level relevance signals.

In other words, operators lost rankings not because their content was weak, but because their platform was not structured for jurisdictional SEO.

This is one of the most under-discussed drivers of SEO performance in iGaming and one of the reasons specialized agencies outperform generalists in this niche.

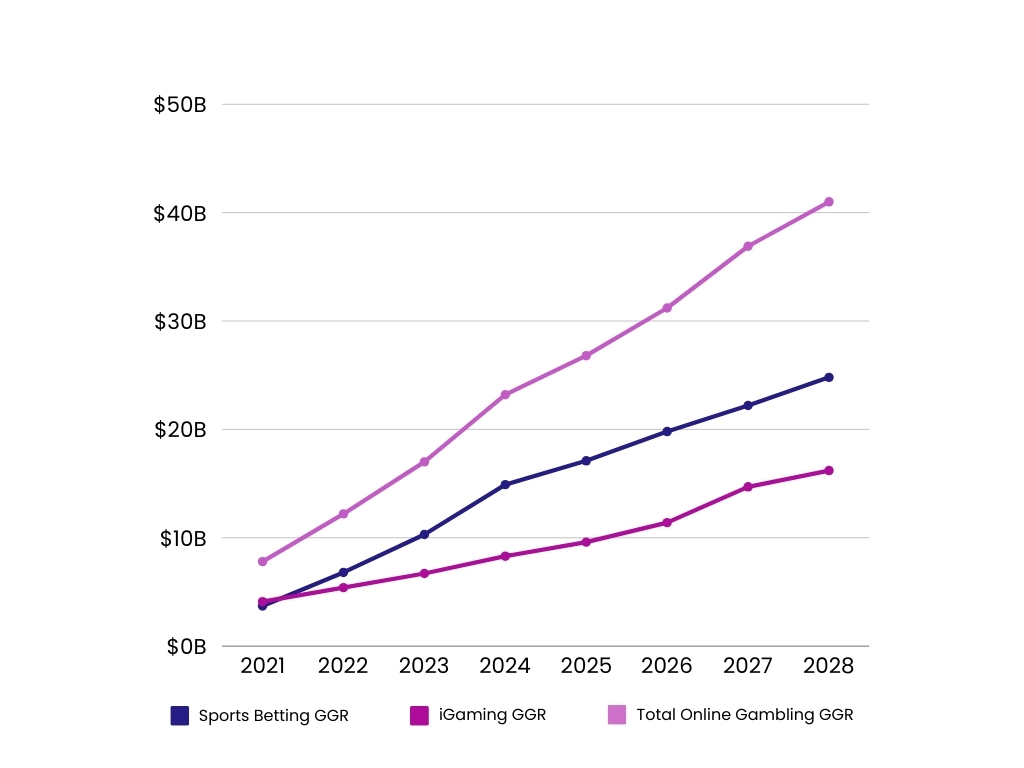

Market Forecasts: The Base-Case Growth Curve (2021–2028)

To understand why 2025 represents a structural turning point rather than a short-term spike, we need to look at projected revenue expansion under the industry’s base-case scenario.

Using the base-case projections referenced in this Vixio 2025 outlook, the U.S. online gambling market is expected to follow the trajectory shown in the table above.

U.S. Online Gambling Base-Case Forecast (2021–2028)

| Year | Sports Betting GGR | iGaming GGR | Total Online Gambling GGR |

| 2021 | $3.7B | $4.1B | $7.8B |

| 2022 | $6.8B | $5.4B | $12.2B |

| 2023 | $10.3B | $6.7B | $17.0B |

| 2024E | $14.9B | $8.3B | $23.2B |

| 2025E | $17.1B | $9.6B | $26.8B |

| 2026E | $19.8B | $11.4B | $31.2B |

| 2027E | $22.2B | $14.7B | $36.9B |

| 2028E | $24.8B | $16.2B | $41.0B |

These projections illustrate three critical realities:

- Sports betting continues to expand, but at a moderated pace compared to its early years.

- iGaming shows consistent upward movement, reinforcing its role as the stability engine.

- Total online gambling revenue nearly doubles between 2024 and 2028 under base-case assumptions.

U.S. Online Sports Betting GGR (Base Case)

The sports betting growth curve shows rapid early expansion (2021–2024), followed by a more mature expansion phase. By 2028, sports betting alone is projected to approach $25B annually.

This reflects both legislative spread and increased per-capita monetization in mature states.

Total U.S. Online Gambling GGR (Base Case)

Total online gambling revenue, including both sports betting and iGaming, shows a strong structural growth line toward $41B by 2028.

This is no longer a speculative market. It is a durable digital vertical.

2025 Marked the Shift From Expansion to Maturity

The defining story of iGaming in 2025 is not just growth. It is structural evolution.

Michigan’s November performance illustrates what maturity looks like in regulated markets: iGaming operating as the economic backbone of online gambling, delivering stable revenue while sports betting drives acquisition spikes. Mature states are no longer experimenting. They are optimizing.

At the same time, Missouri’s December 2025 launch demonstrates the economics of early-stage markets. While more than $543 million was wagered in the first month, heavy promotional deductions limited immediate tax yield. The launch confirms strong consumer demand, but also highlights the high cost of competitive entry.

These two markets, taken together, capture the full lifecycle of U.S. iGaming in 2025: explosive demand in new jurisdictions and disciplined revenue architecture in mature ones.

National forecasts reinforce this trajectory. With total online gambling projected to grow from roughly $26.8 billion in 2025 to $41 billion by 2028, expansion is expected to continue, though incrementally, state by state. Missouri is now live. Other states are debating legislation. Progress is steady, not sudden.

In that environment, competitive advantage shifts.

It moves away from launch-phase promotional intensity and toward long-term efficiency. It favors operators and affiliates that build durable visibility, authority, and infrastructure across jurisdictions rather than chasing short-term acquisition spikes.

That is why 2025 became the inflection point.

Not because the market expanded, but because it matured.

And in mature markets, scalable acquisition systems, compliance-driven content, and state-level visibility are what separate participants from leaders.

As the industry moves through 2026 and toward 2028, the brands that invested early in sustainable organic growth are positioned to benefit most from each new state opening and each incremental regulatory shift.

The next phase of iGaming growth will not be won in the first month of a market launch. It will be won in the years before it.

FAQs

What defined the U.S. iGaming market in 2025?

The defining characteristic of the U.S. iGaming market in 2025 was maturity. Growth continued, but the focus shifted from rapid expansion to sustainable profitability. Mature states like Michigan demonstrated that iGaming, not just sports betting, became the economic backbone of regulated markets. At the same time, new launches such as Missouri highlighted the high cost of promotional-driven acquisition in early-stage markets.

The market began prioritizing long-term efficiency over short-term handle spikes.

How large was the U.S. iGaming market in 2025?

Base-case projections estimated total U.S. online gambling revenue at approximately $26.8 billion in 2025, with forecasts suggesting expansion toward $41 billion by 2028. Sports betting continues to dominate headline revenue, but iGaming (online casino) shows consistent growth and stronger margin stability.

This trajectory confirms that U.S. iGaming is no longer emerging: it is structurally embedded in the digital entertainment economy.

Why is iGaming more stable than sports betting?

Sports betting revenue tends to fluctuate with major events such as NFL playoffs or March Madness. iGaming, by contrast, operates continuously and generates recurring engagement through slots, table games, and live dealer formats.

In mature states, iGaming often delivers more predictable revenue and stronger lifetime value, making it a critical component of long-term operator strategy.

Which states expanded or changed betting legislation in 2025?

Missouri officially launched legal sports betting in December 2025 after voter approval. Other states – including Georgia, South Carolina, Mississippi, and Nebraska – introduced legislative proposals to authorize or expand online sports betting.

However, U.S. expansion remains incremental and state-driven, reinforcing the importance of jurisdiction-specific strategy.

Read our other articles

Online Gambling in Missouri: Is It Legal? Rules, Regulations, and What Changed in 2026

Is online gambling legal in Tennessee? Understanding the legal status

Where is online sports betting legal in 2026: A guide for the U.S.